madinaschool.ru

Recently Added

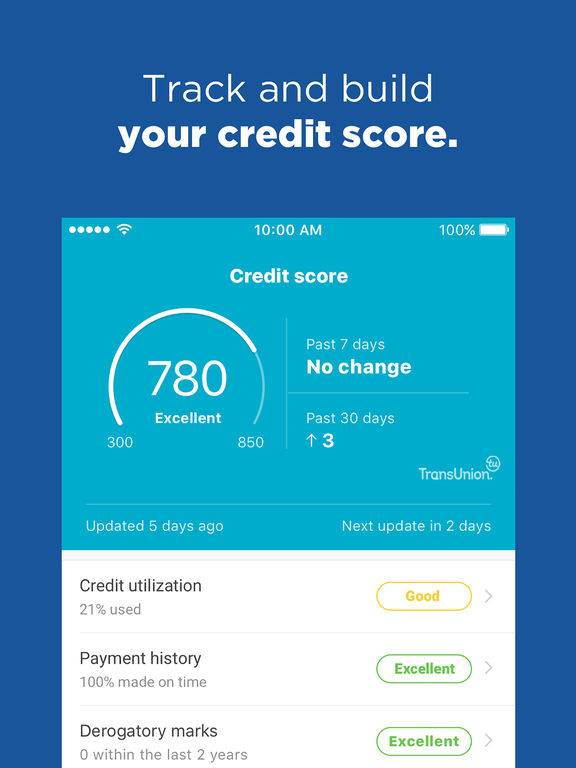

Check Credit Score Nerdwallet

How to Improve Your Credit Score · Make your credit card payments on time every month. Pay every bill by the due date, even if you can only cover the minimum due. When you apply, PayPal Credit completes an initial credit check that does not impact your credit score if declined. An approved PayPal Credit application. Your credit is a powerful tool. Dig into your credit score and report, understand how to influence your score and how to protect your credit. PNC, NerdWallet's #1 HELOC lender for , is ideal for paying off credit cards, home renovations, mortgage refinance & allows you to lock a fixed rate. NerdWallet is our favorite totally free app. It combines bank account imports and transaction management with excellent information about your credit score. It. MyCredit Guide by American Express, Weekly full report · TransUnion · Last 4 digits only, VantageScore ; NerdWallet, Weekly full report · TransUnion · Last 4. Uncertain on checking credit score on NerdWallet or Bank of America. I know it says that it won't impact my score.. but I need to hear it from. A good credit score is to on the scale used by the main scoring companies, FICO and VantageScore. Here's what a good score. You can get a free credit score from a personal finance website such as NerdWallet, which offers a VantageScore using data from your TransUnion credit. How to Improve Your Credit Score · Make your credit card payments on time every month. Pay every bill by the due date, even if you can only cover the minimum due. When you apply, PayPal Credit completes an initial credit check that does not impact your credit score if declined. An approved PayPal Credit application. Your credit is a powerful tool. Dig into your credit score and report, understand how to influence your score and how to protect your credit. PNC, NerdWallet's #1 HELOC lender for , is ideal for paying off credit cards, home renovations, mortgage refinance & allows you to lock a fixed rate. NerdWallet is our favorite totally free app. It combines bank account imports and transaction management with excellent information about your credit score. It. MyCredit Guide by American Express, Weekly full report · TransUnion · Last 4 digits only, VantageScore ; NerdWallet, Weekly full report · TransUnion · Last 4. Uncertain on checking credit score on NerdWallet or Bank of America. I know it says that it won't impact my score.. but I need to hear it from. A good credit score is to on the scale used by the main scoring companies, FICO and VantageScore. Here's what a good score. You can get a free credit score from a personal finance website such as NerdWallet, which offers a VantageScore using data from your TransUnion credit.

NOTE - you'll need to unlock the credit at all 3 agencies whenever a lender or anyone else needs to look at your credit. It's a minor hassle. Thanks to our Nerdy experts, see side-by-side comparisons and objective reviews of the best credit cards, bank accounts, and so much more. NerdWallet dive into a comprehensive credit card checklist to maximize your travel experience. Finally, they discuss the impact on your credit score when you. Free Credit Score Opens in a new window. EXPLORE PRODUCTS. Credit Cards. Link Check for Offers Opens Check for Offers category page in the same window. Use madinaschool.ru to request your credit reports — you have free weekly access. Updated Oct 24, Your credit score View your credit score anytime, anywhere in the mobile app or online banking. It's easy to enroll, easy to use and free to U.S. Bank customers. Get your free VantageScore credit score - updated every 14 days! · Check your credit score for free · Why madinaschool.ru? · Your credit score basics · What factors. people have already reviewed NerdWallet. Read about their experiences and share your own! They offer valuable insights into how carrying a balance affects your credit score, the safety of checking your credit score regularly, and the importance of. Checking your credit score weekly is a good habit to develop, so you can see your credit-building progress and watch for signs of trouble. Free credit scores from WalletHub are the only free credit scores updated DAILY. So check your credit score for free on WalletHub & stay up to date. Then zoom in on the details of your cash flow, expenses, credit score and net worth. Plus, get Nerd-approved tips to help you manage your finances and work. I actively check my FICO score via my Wells Fargo credit card and have slowly but surely increased my score to its current + score. Track your budget, finances and credit - all in one place and all for free. Get the insights you need to make the most of your money. Get Your Free Credit Score · CreditWise® from Capital One® provides VantageScore scores from TransUnion, with email alerts when your TransUnion credit report. Yes, you can check your credit report and credit score without it hurting your score. Start by going to madinaschool.ru and request your free reports. Get access to personal banking services including no monthly fee checking, high-yield savings, cash advances up to $ and more with Varo Bank. Check out how our Nerd @madinaschool.ru allocates her expenses in Scottsdale, Arizona, using the NerdWallet app. From mortgage payments to. MyCredit Guide by American Express, Weekly full report · TransUnion · Last 4 digits only, VantageScore ; NerdWallet, Weekly full report · TransUnion · Last 4.

Buying Stocks At Limit

A sell stop limit is a conditional order to a broker to sell the stock when its price falls up to a specific price – i.e., stop price. A sell stop price has two. With a 'limit buy' you never pay more than the price you set. And with a 'limit sell' you never get less than your chosen price. However, if your price is not. A limit order is an order to buy or sell a security at a specific price or better. A buy limit order can only be executed at the limit price or lower, and a. The stop price is based on the best available price — not necessarily the price you set. The limit price adds an extra control by setting a more precise price. An order is an instruction to buy or sell on a trading venue such as a stock market, bond market, commodity market, financial derivative market or. An order is an instruction to buy or sell on a trading venue such as a stock market, bond market, commodity market, financial derivative market or. Limit orders allow you to specify the maximum price you'll pay when buying securities, or the minimum you'll accept when selling them. A market order is designed to execute at a stock's current price—the market price—when the order reaches the exchange. You'll buy at the ask price or sell. A limit order is an instruction for a broker to buy a stock or other security at or below a set price, or to sell a stock at or above the indicated price. A sell stop limit is a conditional order to a broker to sell the stock when its price falls up to a specific price – i.e., stop price. A sell stop price has two. With a 'limit buy' you never pay more than the price you set. And with a 'limit sell' you never get less than your chosen price. However, if your price is not. A limit order is an order to buy or sell a security at a specific price or better. A buy limit order can only be executed at the limit price or lower, and a. The stop price is based on the best available price — not necessarily the price you set. The limit price adds an extra control by setting a more precise price. An order is an instruction to buy or sell on a trading venue such as a stock market, bond market, commodity market, financial derivative market or. An order is an instruction to buy or sell on a trading venue such as a stock market, bond market, commodity market, financial derivative market or. Limit orders allow you to specify the maximum price you'll pay when buying securities, or the minimum you'll accept when selling them. A market order is designed to execute at a stock's current price—the market price—when the order reaches the exchange. You'll buy at the ask price or sell. A limit order is an instruction for a broker to buy a stock or other security at or below a set price, or to sell a stock at or above the indicated price.

Buy stop orders are placed above the market price at the time of the order, while sell stop orders are placed below the market price. As such, stop orders are. A limit order might be used when you want to buy or sell at a specific price. If you are concerned about risks to the market, one action you can take is to. With a sell limit order, a stock is sold at your limit price or higher. Your limit price should be the minimum price you want to get per share. Example: Stock X. When you place a limit order to sell, the stock is eligible to be sold at or above your limit price, but never below it. Although a limit order enables you to. Limit buys let you set the highest price you're willing to pay for a security. Your order will only execute if the ask price reaches or goes below that price. With a Limit Order you set a minimum price (in case of a sell) or maximum price (in case of a buy) for which you want to execute your order. A buy limit order can be placed at ₹90 and the stock will be bought at ₹90 or lower. Sell limit order. Assume the Current Market Price (CMP) of a share is ₹ Limit buys let you set the highest price you're willing to pay for a security. Your order will only execute if the ask price reaches or goes below that price. In a limit order, you will have to specify the quantity you want to buy and sell and also your desired price. The order will not be executed at any other price. When you buy stock using Cash App Investing, you are limited to 3 day trades within a rolling 5 day trading period. For example: On Monday. A stop-limit order triggers a limit order once the stock trades at or through your specified price (stop price). Your stop price triggers the order; the limit. A stop-limit order allows investors to set specific price parameters for buying or selling securities. XYZ stock has a current Ask price of and you want to use a Limit order to buy shares when the market price falls to You create the Limit. When a buy limit order is placed with a price higher than the current market price, the limit order functions as a market order, offering market protection. When a limit order is placed to buy the stocks of a particular company, the order has to be executed within the same trading session. Taking the same example as. Limit orders for more than shares or for multiple round lots (, , , etc.) may be filled completely or in part until completed. It may take more. For Example: A buy limit order can be put in for $ when a stock is trading at $ If the price dips to $, the order will automatically be executed. A. Placing a limit order · Navigate to 'Invest' on the bottom menu · Select your desired instrument and tap 'Trade' · Choose 'Buy' and then tap the dropdown menu. A limit order allows investors to buy or sell securities at a price they specify or better, providing some price protection on trades. A Stop-Limit order is an instruction to submit a buy or sell limit order when the user-specified stop trigger price is attained or penetrated.

Examples Of Index Funds

Traditional (or market-cap) index mutual funds. This is a popular type of fund that tracks indexes weighting companies based on the market value of their stock. Index funds are comparatively low cost and save investors commissions. For example, buying the SPDR S&P Trust ETF provides exposure to companies in one. The S&P Index, the Russell Index, and the Wilshire Total Market Index are just a few examples of market indexes that index funds may seek to track. Index investment funds are collective investment undertakings whose investment policy strives to mimic a certain index. For example, an index fund tracking. Investors in both ETFs and index mutual funds own shares in a fund, not the individual securities in the fund's portfolio. ETFs and index mutual funds typically. DIA. SPDR Dow Jones Industrial Average ETF Trust, , +, + ; VTI. Vanguard Total Stock Market Index Fund ETF Shares, , +, + An "index fund" describes a type of mutual fund or unit investment trust (UIT) whose investment objective typically is to achieve approximately the same. Vanguard, the world's largest index fund company, now has over $5 trillion in assets, and Blackrock, the second largest provider of index funds and ETFs, has. Index mutual funds & ETFs. Index funds are designed to keep pace with market returns because they try to mirror certain market segments. Actively managed funds. Traditional (or market-cap) index mutual funds. This is a popular type of fund that tracks indexes weighting companies based on the market value of their stock. Index funds are comparatively low cost and save investors commissions. For example, buying the SPDR S&P Trust ETF provides exposure to companies in one. The S&P Index, the Russell Index, and the Wilshire Total Market Index are just a few examples of market indexes that index funds may seek to track. Index investment funds are collective investment undertakings whose investment policy strives to mimic a certain index. For example, an index fund tracking. Investors in both ETFs and index mutual funds own shares in a fund, not the individual securities in the fund's portfolio. ETFs and index mutual funds typically. DIA. SPDR Dow Jones Industrial Average ETF Trust, , +, + ; VTI. Vanguard Total Stock Market Index Fund ETF Shares, , +, + An "index fund" describes a type of mutual fund or unit investment trust (UIT) whose investment objective typically is to achieve approximately the same. Vanguard, the world's largest index fund company, now has over $5 trillion in assets, and Blackrock, the second largest provider of index funds and ETFs, has. Index mutual funds & ETFs. Index funds are designed to keep pace with market returns because they try to mirror certain market segments. Actively managed funds.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve. Investing involves risks, including. An index fund (also index tracker) is a mutual fund or exchange-traded fund (ETF) designed to follow certain preset rules so that it can replicate the. Examples of market indexes that they attempt to track include the Russell Index, the Wilshire Total Market Index, and the S&P Index. Filters ; RBF · RBC Global Bond Index ETF Fund · F ; RBF · RBC Canadian Corporate Bond Fund · F ; RBF · RBC $U.S. Investment Grade Corporate Bond Fund · F. Broad diversification with just 4 index funds · Vanguard Total Bond Market Index Fund (VBTLX) · Vanguard Total International Bond Index Fund (VTABX) · Vanguard. Index funds 'track' the overall performance of an entire So sometimes the index fund might buy a representative sample of shares or bonds instead. Index investing: This includes mutual funds and exchange traded funds (ETFs) that seek to track the performance of a specified index. These “index” funds. What are the best index funds to buy? · FSKAX - Total US Stock Market. This includes all companies in the Fidelity plus Mid-cap and Small-cap. As the name suggests, an Index Mutual Fund invests in stocks that imitate a stock market index like the NSE Nifty, BSE Sensex, etc. These are passively managed. Investors in both ETFs and index mutual funds own shares in a fund, not the individual securities in the fund's portfolio. ETFs and index mutual funds typically. Index funds are mutual funds or exchange-traded funds (ETFs) that are designed to track the performance of a market index. What's an index fund? An index fund is a mutual fund or ETF that's designed to try to match the performance of a market index. For example, if the S&P is. Index Fund is an investment fund designed to track the components of a market index, offering diversified exposure to stocks or bonds. An index fund has a passive investment strategy. Its portfolio invests in all or part of the constituent stocks or bonds of a particular index based on their. Examples of custom index funds include the Global X Millennials Thematic ETF and the Invesco Solar ETF. 5. Market capitalization index funds. Market. Both include a pool of many different stocks and offer a way to diversify and protect your investments. In fact, most index funds are a type of mutual fund. What are index funds? · On-exchange, passively managed funds like ETFs and exchange traded commodities (ETCs) · On-exchange, actively managed funds like. Index funds 'track' the overall performance of an entire So sometimes the index fund might buy a representative sample of shares or bonds instead. Index Funds are the most advocated way to invest by legendary investors like Warren Buffett for retail investors. Free from Fund Managers' biases, this list. S&P index funds are some of the most well-known and popular, but there are index funds that track every type of market index. Some other examples would.

Search Eid Number

You can also dial the code *#06# on your iPhone keypad to display the EID directly on your screen. Get your Ubigi eSIM today and stay connected wherever you are. Applying for an EIN is a free service offered by the Internal Revenue Service. Businesses can apply for an EIN by phone, fax, mail, or online. To find out the EID of your Apple iPhone 15 Pro, dial *#06#. To locate the EID of your device through the menu, follow these steps: Go to the Home screen. Employee Identification Number (eID). Every employee and student is Search CSU. © Colorado State University, Fort Collins, Colorado You can view your EID (EMU Identification number) and PIN (Personal Identification number) from your madinaschool.ru webpage. This guide provides detailed information on how to find EID tag numbers or TSU numbers from your previous Allflex orders. Important tips: Use the details. An EID is a serial number attached to a device that uses an eSIM. T-Mobile will need to update this number on your account before the activation of your. Press the Home key to return to the home screen. 1. Find "Status information. 1. From the home screen, select the settings app Settings app. 2. Select General, then select About. Image 1 3. Scroll down to view the device's Serial Number. You can also dial the code *#06# on your iPhone keypad to display the EID directly on your screen. Get your Ubigi eSIM today and stay connected wherever you are. Applying for an EIN is a free service offered by the Internal Revenue Service. Businesses can apply for an EIN by phone, fax, mail, or online. To find out the EID of your Apple iPhone 15 Pro, dial *#06#. To locate the EID of your device through the menu, follow these steps: Go to the Home screen. Employee Identification Number (eID). Every employee and student is Search CSU. © Colorado State University, Fort Collins, Colorado You can view your EID (EMU Identification number) and PIN (Personal Identification number) from your madinaschool.ru webpage. This guide provides detailed information on how to find EID tag numbers or TSU numbers from your previous Allflex orders. Important tips: Use the details. An EID is a serial number attached to a device that uses an eSIM. T-Mobile will need to update this number on your account before the activation of your. Press the Home key to return to the home screen. 1. Find "Status information. 1. From the home screen, select the settings app Settings app. 2. Select General, then select About. Image 1 3. Scroll down to view the device's Serial Number.

You can find your EIN number by checking old tax returns. The nine-digit number will be found on the top-right corner of the first page of your Form Find your phone's EID number · Your phone's box. · Your phone's Settings app: Tap About phone and then SIM status. Find 'EID'. Search Search. Home · About · Businesses · Real Property · Tax The Tax ID number is actually called a “Federal EIN” (Federal Employer Identification Number). To check for your IMEI and EID numbers you have to head to the Settings app on your smartphone. Click on the General option and select About. Your phone's EID number is displayed below EID. Slide your finger upwards starting from the bottom of the screen to return to the home screen. Press the settings icon. Press About phone. Press Status information. Your phone's EID number is displayed below EID. Press the Home key to return to. The IRS and other government employment agencies use this number to identify tax payers that are required to file various business tax returns. 4. How do I get. Press SIM status. Your phone's EID number is displayed below EID. Slide your finger upwards starting from the bottom of the screen to return to the home. Learn about Opening a Business in Delaware, Start Set Up Your Business's Legal Structure, Get a Federal Employer Identification Number. An EID confirms your identity and US citizenship. You can use it to enter the United States from Canada, Mexico, or the Caribbean through a land or sea port of. Find your phone's EID number · Your phone's box. · Your phone's Settings app: Tap About phone and then SIM status. Find 'EID'. I want to add esim to my S21fe but I can't able to find the 32 digit EID number please let me know where can I find it. 1. From the home screen, select the settings app Settings app. 2. Select General, then select About. Image 1 3. Scroll down to view the Serial Number, IMEI &. Press the settings icon. Press About phone. Press Status information. Your phone's EID number is displayed below EID. Press the Home key to return to. 1. From the home screen, select the settings app Settings app. 2. Select General, then select About. Image 1 3. Scroll down to view the device's Serial Number. Are involved with a number of types of organizations including but not limited to trusts, estates, and non-profits1. How to Get an Employer Identification. Search Corporations, Limited Liability Companies, Limited Partnerships, and Trademarks by FEI Number · Other Search Options. If you cannot find the information that you are looking for on the UT Directory, try the University Community EID Listing. This will allow you to look up UT. You can apply for an EIN online, by mail, or by fax. You may also apply by telephone if your organization was formed outside the U.S. or U.S. territories. Make. 1. From the home screen, select the settings app Settings app. 2. Select General, then select About. Image 1 3. Scroll down to view the Serial Number, IMEI &.

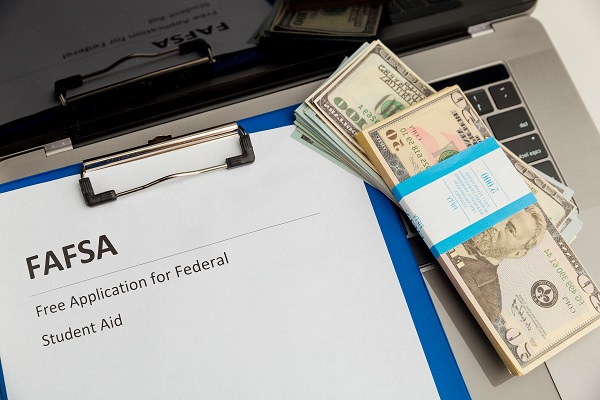

Fafsa Aid Amount

According to the EFC Formula Guide for the FAFSA, the income protection allowance for a married couple with one child in college is $21, These. Over $ million awarded to undergraduate, graduate, and professional students. · $12, in average amount of student federal financial aid awarded · $ $57, for undergraduates-No more than $23, of this amount may be in subsidized loans. $, for graduate or professional students-No more than $65, A financial aid package refers to the combination of various forms of financial assistance offered to a student to help cover the costs of their education. Making McDaniel Affordable. More than 90% of McDaniel College students receive some type of financial assistance. We invest nearly $55 million annually in need-. $35, minus SAI of , minus = Financial Need (Maximum amount of need-based aid you can receive)*, $34, *The types and amounts of any financial. So if the college's total cost is $60,, and a student's SAI is $15,, that student is eligible to receive $45, in need-based financial aid. Federal Grants may be awarded based on financial need, as demonstrated on the Free Application for Federal Student Aid (FAFSA), and do not need to be repaid. There's no official income cutoff to qualify for federal student aid. Yes, your family's annual income influences your aid package, but other factors, such as. According to the EFC Formula Guide for the FAFSA, the income protection allowance for a married couple with one child in college is $21, These. Over $ million awarded to undergraduate, graduate, and professional students. · $12, in average amount of student federal financial aid awarded · $ $57, for undergraduates-No more than $23, of this amount may be in subsidized loans. $, for graduate or professional students-No more than $65, A financial aid package refers to the combination of various forms of financial assistance offered to a student to help cover the costs of their education. Making McDaniel Affordable. More than 90% of McDaniel College students receive some type of financial assistance. We invest nearly $55 million annually in need-. $35, minus SAI of , minus = Financial Need (Maximum amount of need-based aid you can receive)*, $34, *The types and amounts of any financial. So if the college's total cost is $60,, and a student's SAI is $15,, that student is eligible to receive $45, in need-based financial aid. Federal Grants may be awarded based on financial need, as demonstrated on the Free Application for Federal Student Aid (FAFSA), and do not need to be repaid. There's no official income cutoff to qualify for federal student aid. Yes, your family's annual income influences your aid package, but other factors, such as.

With college expenses of $19, a year, the student will have a financial need of $2, and will probably not be eligible for much financial aid. But next. According to the EFC Formula Guide for the FAFSA, the income protection allowance for a married couple with one child in college is $21, These. Meet the minimum credit requirements for the type of aid; Meet Satisfactory Academic Progress standards; Not have loans in excess of loan limits; Not be in. By now, you may have heard of something called FAFSA—the Free Application for Federal Student Aid. It's the key to getting money for your education based on. The amounts range between $ and $4, per year.7 As with Pell Grants, these supplemental grants are meant for students with few other financial resources. The formula is: your estimated cost of attendance minus your SAI equals your financial need. The information you provide in your FAFSA form—including your. When colleges begin the process of compiling financial aid offers, they first calculate your Student Aid Index (SAI). This amount is intended to reflect your. Student's taxable college grant and scholarship aid (included as income). This amount is self-reported on the FAFSA. Student's education credits. Use the amount. In reality, there's no maximum income cap that determines your eligibility for aid. Although your earnings are a factor on the FAFSA, only some programs are. Once the Office of Student Financial Aid has received and reviewed your FAFSA Use our Net Price Calculator to estimate the amount of financial aid you'll. Financial aid eligibility is based on a student's financial need, which is the difference between the college's Cost of Attendance (COA) and the student's. The Student Aid Estimator shows the amount of federal student aid you could receive from the Canada Student Financial Assistance Program. For , the annual cost of tuition and fees for full-time undergraduate students is approximately $44, Students residing on-campus or in University-. A Federal Pell Grant is a need-based financial aid program for undergraduate college students. The amount of the grant varies depending on factors like your. The amount of Pell Grant eligibility is determined by the Department of Education. The information you provide on your FAFSA is placed into a formula which. The amount the school is required to provide is either the amount of your credit balance or the amount needed for books and supplies (as determined by your. No, there's no age limit. Almost everyone is eligible for some type of federal student aid. The adult student still needs to complete the FAFSA form, and make. How Much Aid Are Students Getting? $ billion: The total amount of aid that undergraduate and graduate students received in from all grants. Your Expected Family Contribution (EFC) is an index number used to determine your eligibility for federal student financial aid. Typical award amount at Southern Miss is between $ - $4, for undergrads and $1, - $9, for graduate students. Federal Work Study Funds are awarded to.

Best Tax Software For Expats

At Abroad, we offer multile different free expat tax tools like our foreign earned income exclusion tool and more. Click here to use our tools today! Here at Universal Tax Professionals, our team of CPAs and IRS Enrolled Agents specialize in providing a wide range of US expat tax services. We are ready to. Our easy US tax software for expats is uniquely designed to let you take control and file your taxes yourself with accuracy and confidence. ✔️ Use the right tools: Utilize tax software Here are some common scenarios where an expat tax pro can be your best friend: 1. I've used it ever since and tell everyone I know that it is the best bet for filing taxes! I filed a couple of late tax years along with the current year and. Many citizens living abroad qualify for special tax benefits which prevent them from being double taxed on foreign-earned income. MyExpatTaxes Review: Probably the most comprehensive and intuitive tax filing software available for Americans abroad in the market. If you have. The first and only tax software created by US Expats for US Expats that makes filing taxes back home easy – so you can enjoy where you are now. Why should I choose Expat Tax Online over free file software? · You want an accurate tax return that factors in your present and future. · You want maximized. At Abroad, we offer multile different free expat tax tools like our foreign earned income exclusion tool and more. Click here to use our tools today! Here at Universal Tax Professionals, our team of CPAs and IRS Enrolled Agents specialize in providing a wide range of US expat tax services. We are ready to. Our easy US tax software for expats is uniquely designed to let you take control and file your taxes yourself with accuracy and confidence. ✔️ Use the right tools: Utilize tax software Here are some common scenarios where an expat tax pro can be your best friend: 1. I've used it ever since and tell everyone I know that it is the best bet for filing taxes! I filed a couple of late tax years along with the current year and. Many citizens living abroad qualify for special tax benefits which prevent them from being double taxed on foreign-earned income. MyExpatTaxes Review: Probably the most comprehensive and intuitive tax filing software available for Americans abroad in the market. If you have. The first and only tax software created by US Expats for US Expats that makes filing taxes back home easy – so you can enjoy where you are now. Why should I choose Expat Tax Online over free file software? · You want an accurate tax return that factors in your present and future. · You want maximized.

Tax software allows you to work on your taxes from the comfort of your home or while on the go. Whether you're a US expat residing in a bustling metropolis or a. For some, the attraction is a great job that happens to be in an exotic land; for others, it's simply the romance of joining the tradition of famous expatriates. Expat taxes: Helping expats manage their tax affairs. We can save you time and money by providing expert tax advice specific to your circumstances. Some of the most well-known firms in this space include Greenback, Expat Tax Online, and Bright!Tax, but I would also throw ExpatFile and. US expat taxes made simple. With Expatfile®'s expat tax software Americans abroad can e-file their own expat tax return and FBAR in as quick as 10 minutes. Why H&CO US Expat Tax services? H&CO is the top choice for American expatriates seeking expert tax solutions abroad. With over thirty years of specialized. Paradoxically the rich selection might even make it hard to pick the best firm - how do you know which one is right for you? software installed on their. expat tax return and FBAR in as quick as 10 minutes. Expatfile is 3 out of 12 best companies in the category Tax Preparation Software on Trustpilot. Filing taxes can be a complex and overwhelming process, especially for expats living outside of the United States. Fortunately, US Tax Pros specialize in. Your taxes are in great hands with US expat tax services from H&R Block. Work with our international tax advisors or do your own online with our easy tools. Let's explore the pros and cons of each approach, allowing you to make an informed decision that best suits your unique expatriate tax situation. Tax Software. The first and most popular US expat tax software. Listed as Best Tax Software for Expatriates in by @thebalance! Do you attend the annual IRS forum where top practitioners in the field interact with IRS top brass? Best German tax return software – Our recommendations · #1.”Wundertax” – User-friendly English Software · #2. “WISO Tax“ Savings Book – Your. American Expat Tax Services is an income tax preparation firm that specializes in all areas of US Income Tax Preparation, Expat Tax Advice, Compliance, and IRS. best opportunity to qualify for the Streamlined amnesty program. Our service includes the preparation of 3 previous tax returns, 6 previous FBAR forms, and. tax software for expats. Our DIY software Best USA Expat Tax Software Company ! This incredible recognition. Specializing in U.S. expat tax services, The Expat Tax CPAs provide a track record for excellence in tax preparation, FBAR, FATCA and late filing. Expat CPA provides expat tax services for Americans living abroad. Click here to learn about your tax obligations and how we can help you meet them.

How Much Does Drivers Insurance Cost

:max_bytes(150000):strip_icc()/how-much-does-car-insurance-cost-5072100_final-915c31d331c9435085f258da3e1e1852.png)

Your rate is determined using a combination of factors or risk characteristics outlined below. You also have many additional coverage options not required by. The coverage limits in your commercial auto policy will tell you the maximum amount of money that your insurer will pay for covered claims. Typically, a higher. Calculate the perfect car insurance coverage for you and instantly compare car the best quotes in Canada. Safer cars get into accidents less frequently and cost less to repair. That means fewer claims on average — and more savings for you. Likelihood of theft. Some. Despite declining claim numbers, rates have climbed from $ in to $ per year currently. That's good enough for the second-lowest average insurance. Factors that affect car insurance rates · Age · Location · Driving record · Claims history · How often you drive · Credit score · Vehicle · Your policy coverages. The average cost of car insurance for G2 drivers in Ontario is $2, yearly. That's $ per month! Other factors, besides driver experience, are taken. How does auto insurance differ from province to province? Auto insurance systems, coverage, and rates vary greatly depending on where you register your vehicle. With experience and a clean record, insurance rates for new drivers should lower in no time. How much will new driver insurance cost? Well, let's first. Your rate is determined using a combination of factors or risk characteristics outlined below. You also have many additional coverage options not required by. The coverage limits in your commercial auto policy will tell you the maximum amount of money that your insurer will pay for covered claims. Typically, a higher. Calculate the perfect car insurance coverage for you and instantly compare car the best quotes in Canada. Safer cars get into accidents less frequently and cost less to repair. That means fewer claims on average — and more savings for you. Likelihood of theft. Some. Despite declining claim numbers, rates have climbed from $ in to $ per year currently. That's good enough for the second-lowest average insurance. Factors that affect car insurance rates · Age · Location · Driving record · Claims history · How often you drive · Credit score · Vehicle · Your policy coverages. The average cost of car insurance for G2 drivers in Ontario is $2, yearly. That's $ per month! Other factors, besides driver experience, are taken. How does auto insurance differ from province to province? Auto insurance systems, coverage, and rates vary greatly depending on where you register your vehicle. With experience and a clean record, insurance rates for new drivers should lower in no time. How much will new driver insurance cost? Well, let's first.

The average cost to add a year-old, newly licensed driver to an adult's existing auto insurance policy is about $ per month, according to Investopedia's. In , the average cost of car insurance is $/year which comes to $ per six-month policy or $/month. Use The Zebra to compare prices. On average, the car insurance cost for a year-old is $ a month. The rates vary by coverage, carriers, vehicle, & other rating factors. Get quotes! Your car insurance rate is affected by factors like driving history, your vehicle and more. Find out how your premium is calculated and how you can save. Insurance companies use a formula based on several identified risks to determine the price of your auto insurance policy. These risks include where you live. The higher the risk, the more you'll pay in insurance. The more crashes you've caused, for example, the more it will cost to insure your car. The good news is. On average, drivers who switched to Allstate saved $, so get your free auto insurance quote today! If your car is also used for commercial purposes. Your personal driving history and that of other household drivers who are listed on your auto insurance policy. How much is car insurance for someone under 25? The average annual car insurance cost for a year-old in the United States is $3, This is 55% less. Then they added a year old teen to the policy. This is what they saw happen to the rates: The average household's car insurance bill rose %. A teenage boy. On a monthly basis, full coverage averages $, with minimum coverage averaging $53 per month. USAA, Auto-Owners and Geico offer some of the cheapest full. G2 insurance is an important consideration for Ontario G2 drivers. There are two main options: You can be added to a guardian/parents plan: this is the most. How much is car insurance per month? Car insurance on average is $ per month in low-cost states, $ per month in medium-cost states, and $ per. Young drivers often pay more for car insurance than any other age group. Learn why car insurance rates for teens are higher and how to find affordable. How much is the average cost of car insurance in the U.S? The average cost for car insurance in the United States is $1, per year, or $ per month. Ontario has $11,,, in premiums) / 7,, (number of personal vehicles) = $1, average auto insurance premiums. Source: ICBC Service Plan. Insurers not only look at how safe a particular vehicle is to drive and how well it protects occupants, but also how much potential damage it can inflict on. Not to mention excellent service, safe-driving tips, and savings as much as 25% to help reduce teen driver insurance costs. ZIP Code. Many factors affect car insurance rates, so premiums can vary widely among drivers. The national average monthly cost of car insurance is $ for full coverage. The average cost of liability-only car insurance for Texas drivers is $ per month, or $1, per year. Drivers who buy full-coverage car insurance pay an.

How Much Can You Make Renting Your Car

Earn up to $ per month by sharing your car with Getaround Connect. You can request whatever you need from your Getaround rental car. Whether. What you could earn. · You car's market value · Days rented out per month · You could earn up to · R 5, · How it works. Find out how to rent out your car through a peer-to-peer car rental service. Learn the requirements and follow these simple steps to start. 5 more reasons you may want to rent a car for a road trip. You love your car too much. If you have a brand spanking new car, you might hesitate to put 5, To help make your holiday as beautiful as possible, Free2move offers rental vehicles at very competitive prices, but also easy to access, as you can notify us. You can do so many things with it. Share your car on TREVO, pay for your car loan, make it a business, or simply to achieve better life quality, like go. The Benefits and Risks of Renting Your Car Out · You can earn passive income, making money while not doing any work · With many car-sharing platforms (and if you. How much can I make if I rent my car out? Our Owners make between $ and $1, per month. This is based on a minimum seven-day rental. However, you could. Skip the car rental counter and rent anything from daily drivers to pickup trucks, from trusted, local hosts on the Turo car rental marketplace. Earn up to $ per month by sharing your car with Getaround Connect. You can request whatever you need from your Getaround rental car. Whether. What you could earn. · You car's market value · Days rented out per month · You could earn up to · R 5, · How it works. Find out how to rent out your car through a peer-to-peer car rental service. Learn the requirements and follow these simple steps to start. 5 more reasons you may want to rent a car for a road trip. You love your car too much. If you have a brand spanking new car, you might hesitate to put 5, To help make your holiday as beautiful as possible, Free2move offers rental vehicles at very competitive prices, but also easy to access, as you can notify us. You can do so many things with it. Share your car on TREVO, pay for your car loan, make it a business, or simply to achieve better life quality, like go. The Benefits and Risks of Renting Your Car Out · You can earn passive income, making money while not doing any work · With many car-sharing platforms (and if you. How much can I make if I rent my car out? Our Owners make between $ and $1, per month. This is based on a minimum seven-day rental. However, you could. Skip the car rental counter and rent anything from daily drivers to pickup trucks, from trusted, local hosts on the Turo car rental marketplace.

How To Rent Your Car Out With DriveMyCar · You can earn $2, in 12 months. Guaranteed. · Earn between $ and $1, per month. Instantly book cars near you. Book on demand by the hour or day, with gas and dedicated parking included. Get your first month on us* with code. Earn $5k to $25k per year. Looking to rent your fleet out full-time? Here are the average annual rental revenues for each vehicle type. If you're comfortable riding with strangers, ridesharing is an excellent option for earning extra cash with your car. Earnings depend on many factors–. we'll call you to plan the installation of our device. Receive bookings. After an identity check, drivers can book your car when you make it available. Rent. All I can find is how to EARN points. I want to REDEEM my points and book a rental car. And exactly, why do you make this so hard to find on your website? To help make your holiday as beautiful as possible, Free2move offers rental vehicles at very competitive prices, but also easy to access, as you can notify us. Weekends and holidays tend to produce higher demand, so you can expect to attract more renters and higher rental rates if you make your car available during. 5 more reasons you may want to rent a car for a road trip. You love your car too much. If you have a brand spanking new car, you might hesitate to put 5, Can you return a rental car to a different location? Yes, Budget does allow you to pick up your rental in one city and drop it off in another. When you make. How much does it cost to rent a car to drive with Uber? Weekly rentals start at Since your rental agreement will be directly with one of our vehicle. In short, car sharing allows you to rent your personal car and make money doing it while providing insurance and security if something goes wrong. We all know. There are a number of reasons for wanting to do this. First, if you have an extra car that you rarely use, renting it out can be a way to earn extra cash. If you need to make a claim for damage on a vehicle you've rented, do so in the same way you would if you are involved in a collision with your own vehicle. How much money do people make car sharing with Avail? When your eligible car is borrowed, you'll earn a fixed amount each day based on your car's class. Hosts of DRIVESHARE have earned over $1,, to date by renting out their cars. image. We've got your back. Earn $5k to $25k per year. Looking to rent your fleet out full-time? Here are the average annual rental revenues for each vehicle type. Start making money by renting out your car today! Zoomcar makes it simple to give your car on rent. Sign up and monetize your idle vehicle effortlessly. If you're leasing or buying used, it should be no more than 10%. The reason for finding a vehicle that falls below 10%% is that the payment isn't the. Turo is the world's largest car rental marketplace, where you can rent the perfect car for wherever you're going from a vibrant international community of.

Does Walmart Pickup Take Ebt

If your KOKUA. EBT has cash benefits, you may use those benefits to pay for the Walmart delivery fee. Can I order and pick up my items? When you buy your. Currently, Walmart does not accept WIC or eWIC. • For Pickup - At most stores, you can pay for your order using an EBT card when you arrive. • Follow these. You can not. You can do OGD/P with EBT but not in store on walmart pay. CalFresh recipients can use their EBT card to purchase groceries online at Albertsons, Aldi via. Instacart, Amazon, Safeway, Vons, and Walmart. You will be. *SNAP / EBT can only be used for club purchases. Pickup orders are Sam's Club gas stations do accept Walmart Credit Cards. Related Articles. How. Illinois' initial Online SNAP EBT option launched in June including Amazon and Walmart. The Illinois Department of Human Services will continue working. You can pay for Walmart online grocery with EBT in all but five states. These states are Arkansas, Alaska, Louisiana, Maine, and Montana. SNAP participants can buy groceries online for pickup or for free grocery delivery. EBT online shopping is currently available through select retailers across. Some stores accept EBT cards for home delivery and/or curbside pick-up. Residents can use their SNAP benefits for online purchasing at the following retailers. If your KOKUA. EBT has cash benefits, you may use those benefits to pay for the Walmart delivery fee. Can I order and pick up my items? When you buy your. Currently, Walmart does not accept WIC or eWIC. • For Pickup - At most stores, you can pay for your order using an EBT card when you arrive. • Follow these. You can not. You can do OGD/P with EBT but not in store on walmart pay. CalFresh recipients can use their EBT card to purchase groceries online at Albertsons, Aldi via. Instacart, Amazon, Safeway, Vons, and Walmart. You will be. *SNAP / EBT can only be used for club purchases. Pickup orders are Sam's Club gas stations do accept Walmart Credit Cards. Related Articles. How. Illinois' initial Online SNAP EBT option launched in June including Amazon and Walmart. The Illinois Department of Human Services will continue working. You can pay for Walmart online grocery with EBT in all but five states. These states are Arkansas, Alaska, Louisiana, Maine, and Montana. SNAP participants can buy groceries online for pickup or for free grocery delivery. EBT online shopping is currently available through select retailers across. Some stores accept EBT cards for home delivery and/or curbside pick-up. Residents can use their SNAP benefits for online purchasing at the following retailers.

Illinois' initial Online SNAP EBT option launched in June including Amazon and Walmart. The Illinois Department of Human Services will continue working. Did you know you can now use a SNAP EBT card for your online Grocery Pickup order? Just choose EBT at checkout and get on your way! Cash assistance cannot be used to purchase items online – only SNAP benefits can be used for online purchasing of eligible foods. Clients will need to use their. Did you know you can now use a SNAP EBT card for your online Grocery Pickup order? Just choose EBT at checkout. #Pickup. Pickup: Swipe EBT card with the Walmart associate when you arrive at the pickup location. When you get to the Walmart Pickup location, the. Walmart accepts EBT for online purchases in 44 states. EBT food stamp recipients can use their benefits to buy food and groceries online for. Georgians can now shop online with SNAP. August 05, Share. About | Contact | Statements · JWT Auth for open source projects. When you buy your groceries online using your EBT card from Walmart, you can pay online using your EBT card and schedule a grocery pick-up for no charge. 7. Walmart is one of many retailers that accepts EBT payments (in 48 states you can pay at checkout, in Alaska and Montana, you can pay at pickup) and a convenient. Massachusetts residents who receive SNAP benefits can use their EBT card to Walmart, as well as ALDI, Big Y, Brothers Marketplace, Hannaford. Walmart online accepts EBT Cash for payments. You can use EBT cash to cover the cost of delivery fees. You can also pick up your groceries at participating. When you buy your groceries online using your EBT card through Walmart, you can schedule a grocery pick-up at no charge. When you buy groceries online using. CalFresh recipients can use their EBT card to purchase groceries online at Albertsons, Aldi via. Instacart, Amazon, Safeway, Vons, and Walmart. You will be. Walmart, known for its wide range of products and competitive prices, accepts EBT for online grocery orders. How to Use: Link your EBT card to. In Mississippi, groceries can be purchased online through Walmart and Amazon using a SNAP EBT card. Shopping online is an easy and convenient way to shop for. Order groceries online at madinaschool.ru and select “Pay with EBT” for payment method. Then just swipe your EBT card when you pickup at our store. For households to make online purchases, the online shopping and payment pilot is required to be secure, private, easy to use, and provide similar support to. SNAP Benefits* Starting April 21 you can now use your EBT card to order groceries online at Walmart and Amazon At pickup swipe your EBT card. SNAP benefits cannot be used to pay for delivery fees. Curbside pickup is available at Walmart to avoid a delivery fee. Amazon is currently offering free. Cash assistance cannot be used to purchase items online – only SNAP benefits can be used for online purchasing of eligible foods. Clients will need to use their.

Federal Tax 2021

Earned income — income you receive from your job(s) — is measured against seven tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. The local income tax is calculated as a percentage of your taxable income. Local officials set the rates, which range between % and % for the current. Your federal tax rates are based on your income level and filing status. The percentages and income brackets can change annually. Enter your parents' total tax amount for Income tax paid is the total amount of IRS Form line 22 minus Schedule 2-line 2. Pay your taxes. Get your refund status. Find IRS forms and answers to tax questions. We help you understand and meet your federal tax responsibilities. The Secret IRS Files: Trove of Never-Before-Seen Records Reveal How the Wealthiest Avoid Income Tax. by Jesse Eisinger, Jeff Ernsthausen and Paul Kiel June. Find out how to get and where to mail paper federal and state tax forms. Learn what to do if you don't get your W-2 form from your employer or it's wrong. your premium tax credit. Use Form A to complete IRS tax Form OTHER TAX YEARS. taxes · taxes · taxes · taxes · taxes · Single taxpayers (1) ; Taxable income (USD), Tax rate (%) ; 0 to 11,, 10 ; 11, to 44,, 12 ; 44, to 95,, 22 ; 95, to ,, Earned income — income you receive from your job(s) — is measured against seven tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. The local income tax is calculated as a percentage of your taxable income. Local officials set the rates, which range between % and % for the current. Your federal tax rates are based on your income level and filing status. The percentages and income brackets can change annually. Enter your parents' total tax amount for Income tax paid is the total amount of IRS Form line 22 minus Schedule 2-line 2. Pay your taxes. Get your refund status. Find IRS forms and answers to tax questions. We help you understand and meet your federal tax responsibilities. The Secret IRS Files: Trove of Never-Before-Seen Records Reveal How the Wealthiest Avoid Income Tax. by Jesse Eisinger, Jeff Ernsthausen and Paul Kiel June. Find out how to get and where to mail paper federal and state tax forms. Learn what to do if you don't get your W-2 form from your employer or it's wrong. your premium tax credit. Use Form A to complete IRS tax Form OTHER TAX YEARS. taxes · taxes · taxes · taxes · taxes · Single taxpayers (1) ; Taxable income (USD), Tax rate (%) ; 0 to 11,, 10 ; 11, to 44,, 12 ; 44, to 95,, 22 ; 95, to ,,

Since , the income tax share of the bottom half of earners has fallen from 7 percent to percent in (compared to percent last year). Marginal tax rate: Your tax bracket explained ; Married Filing Jointly ; Income, Tax Bracket ; $22,, 10% ; $89,, 12% ; $,, 22%. Use MyTax Illinois to electronically file your original Individual Income Tax Return. It's easy, free, and you will get your refund faster. The installation of the system must be complete during the tax year. Solar PV systems installed in 20are eligible for a 26% tax credit. In. There are seven different income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Generally, these rates remain the same unless Congress passes new tax. Your federal tax rates are based on your income level and filing status. The percentages and income brackets can change annually. Since , the income tax share of the bottom half of earners has fallen from 7 percent to percent in (compared to percent last year). Individual Income Tax rates range from 0% to a top rate of 7% on taxable income for tax years and prior, from 0% to a top rate of % on taxable income. Enter your parents' total tax amount for Income tax paid is the total amount of IRS Form line 22 minus Schedule 2-line 2. You will claim the other half when you file your income tax return. These changes apply to tax year only. See more. Who is eligible for Child Tax. tax brackets and federal income tax rates ; 10%, $0 to $9,, $0 to $19, ; 12%, $9, to $40,, $19, to $81, ; 22%, $40, to $86,, $81, For tax year , Maryland's personal tax rates begin at 2% on the first $ of taxable income and increase up to a maximum of % on incomes exceeding. Marginal tax rates and income brackets for Marginal tax rate, Single taxable income, Married filing jointly or qualified widow(er) taxable income. Need paper Individual or School District Income Tax forms mailed to you? Call the hour form request line at to order Individual and School. MO Print OnlyPDF Document, Individual Income Tax Return, , 12/28/ MO Print OnlyPDF Document, Individual Income Tax Return, , 3/15/ The American Taxpayer Relief Act of increased the highest income tax rate to percent. The Patient Protection and Affordable Care Act added an. The credit amount was increased for The American Rescue Plan increased the amount of the Child Tax Credit from $2, to $3, for qualifying children. HOME Tax Notes Research Federal Reference Tables. 6. Standard Deduction. 6 $25, $24, $24, $24, $12, For Tax Years , , and the North Carolina individual income tax rate is % (). For Tax Years and , the North Carolina individual. Your 2nd stimulus payment (approved January ) and 3rd stimulus payment (approved March ) cannot be garnished to pay child support.